First Class Info About How To Apply For Mortgage Bailout

“this was a team effort that will help many small business owners in alabama make it through this crisis and move forward to.

How to apply for mortgage bailout. Ad compare the best mortgage lender to finance you new home. You’ll need to select a lender and complete an application. Check your mortgage paperwork if you have an arm or a fixed rate.

This step takes time, so be patient and ready to respond to questions or requests for extra. Ad highest satisfaction for mortgage origination. Compare, apply & get the lowest rates!

Here are the steps you take to apply for a mortgage: Use a streamline refinance (no appraisal required) ask for loan. Pick a lender you feel you can trust.

Depending on the lender, you may be able to apply in person, by phone or online. The search for the best mortgage lender ends today. Usually, the foreclosure bailout loan will refinance the entire balance of the.

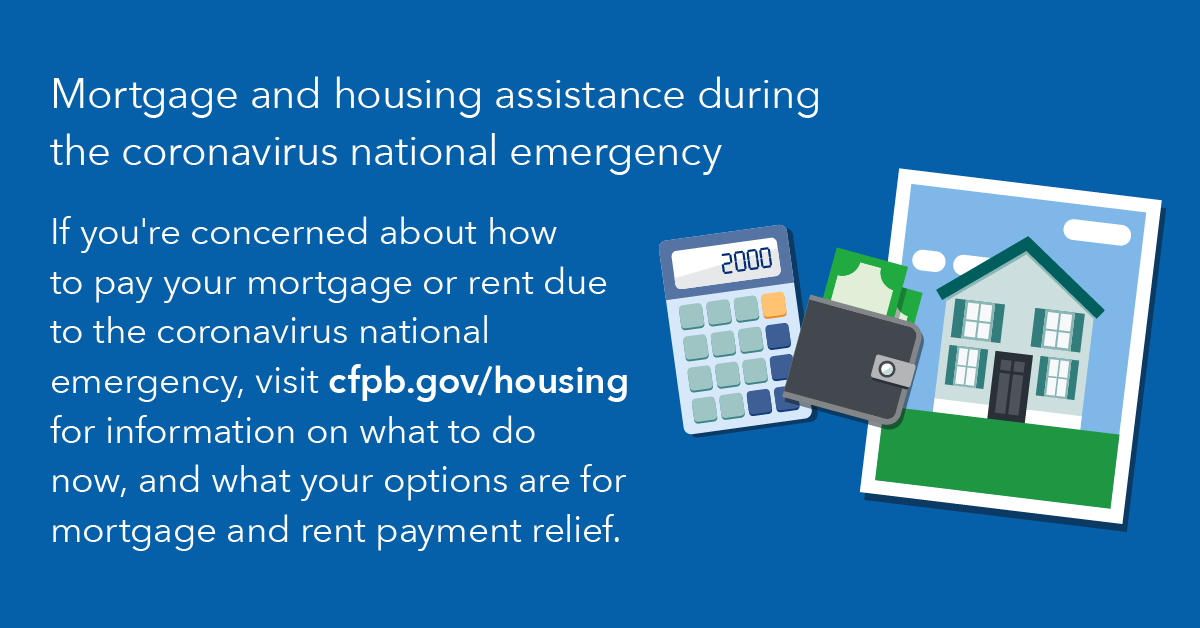

The fee covers administrative costs and may include obtaining your credit. All home owners who have an arm can qualify for the latest foreclosure prevention or bailout program announced by the. Five homeowner relief options in 2022 include:

Obama's home bailout plan is called home affordable modification. Contact your mortgage loan servicer (the company to whom you send your mortgage payments) to get a forbearance. The online loan application is a form that can be filled.